IPC portfolio monitoring tool: designed by risk managers for risk managers

CLIENT

Banks and MFIs

YEAR

since 2020

COUNTRY / REGION

Globally

EXPERTISE

KEY TOPICS

CONTACT

Managing portfolio quality and credit risk are essential to the long-term health and solvency of financial institutions… but many financial institutions still struggle to better assess, monitor and manage credit risk in their portfolios.

Risk managers at financial institutions often lack fitting tools that are both flexible and powerful to allow them to analyse both the current state and historical trends of their loan portfolios.

In IPC’s experience in working hands-on with risk managers across the globe, a common “wish list” of capabilities critical for monitoring the credit portfolio and managing department activities has become a refrain. These functionalities include:

- Being able to immediately access and analyse daily status updates on Key Risk Indicators (KRIs) such as PAR—both aggregated at the portfolio and broken down by key factors such as geography, branch, product, collateral, etc.

- Having the ability to track changes in KRIs over time to analyse trends and monitor portfolio change or deterioration in a dynamic way

- Rapidly tabulating probability of default (PD) to facilitate the calculations of expected loss, provisioning and capital adequacy

- Accessing portfolio data and breakdowns that can be rapidly plugged into standardised templates to measure impact on profitability, liquidity and currency mismatches

- Having a tool that is both flexible and efficient – ideally risk managers have the capacity to quickly generate reports about portfolio KRIs, potentially with particular portfolio segmentation, without having to initiate longer conversations with IT teams to build new reports

IPC has designed the portfolio monitoring tool to meet these needs of portfolio risk managers. The tool is a pragmatic data warehousing and analysis solution for credit risk management, acting as an interface between the risk management department and the main source of data at a financial institution (e.g. core banking systems).

The portfolio monitoring tool is simple but powerful:

- Providing much of the comprehensive functionality of expensive business intelligence (BI) solutions – at a fraction of the cost

- Replicating the flexibility, ease and efficiency of basic tools such as Excel spreadsheets – while allowing for more complex analyses

- Allowing for significant customisation to an institution’s context – without a time-consuming or expensive implementation process

The portfolio monitoring tool stores historical data and displays portfolio snapshots and trends on easy-to-follow dashboard, including early warning indicators.

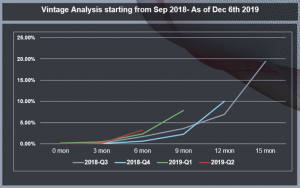

The tool also allows risk managers to engage in more sophisticated portfolio analyses, including vintage analysis and migration analysis, increasing the depth of understanding and monitoring of the portfolio.

IPC’s portfolio monitoring tool is simple to install and customise and has been designed to be fully owned and fully housed at financial institutions utilising Microsoft Office at its core.

In a matter of days, the portfolio monitoring tool can be fully functional, giving risk managers a powerful tool to look deeper into the portfolio, allowing them to identify and understand risks that – for many – may be presently hidden.